WOTC Billing: Accessing your Detailed Monthly Reports

WOTC Billing: Accessing your Detailed Monthly Reports

We’ve recently made

changes to our WOTC billing process. Each month you will receive a summary

invoice that includes the total WOTC charges for the previous month.

With this billing process change, we’ve updated

EHX so that you can access the detailed monthly WOTC credit reports from within

EHX. You can also preview your current credits gained at any time during the

month!

Access

Your Monthly Credit Reports:

- Log into your EHX site with your Administrator login

credentials.

- Select WOTC Reports from

the main menu, then select Payroll

& Credit Reporting. The WOTC Payroll & Credit

Report page displays.

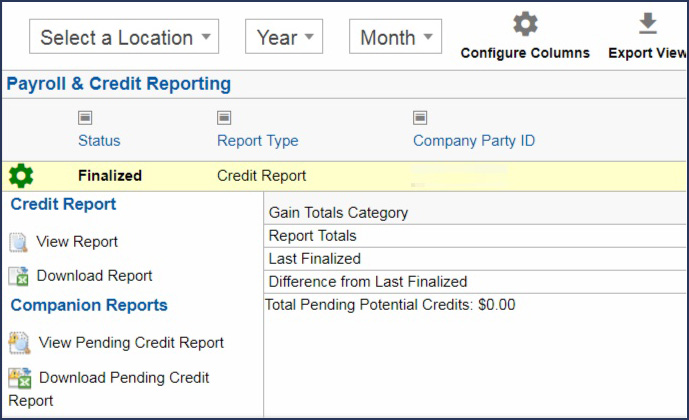

This dashboard view displays a list of all

WOTC billing reports generated, sorted descending by date; the most recent

credit report will be at the top.

3. Click the green actions gear for the report you want to view. The Action Pane expands.

Totals Tab:

The Report Totals row displays the Unclaimed, Claimed, and Total Credits from inception to report date.

The Last Finalized row displays the Unclaimed, Claimed, and Total Credits from the previously Finalized report from inception to report date.

The Difference from Last Finalized row displays the Unclaimed, Claimed, and Total Credits difference between the last Finalized report and this report.

Your WOTC Credits invoice total for this month is based upon the number

in this column.

Available Actions:

To

view the final credit report for this month in your browser, click View

Report.

- Red text indicates a decrease in a numerical value from the previous value.

- Green text indicates an increase in a numerical value from the previous value.

- Blue text indicates a change in a non-numerical value like a change in Group Code.

To

download the final credit report for this month as an Excel spreadsheet,

click Download Report.

To

view the pending credits through this month in your browser, click View

Pending Credit Report.

To

download the pending credits through this month as an Excel spreadsheet,

click View Pending Credit Report.

Preview

your Current Credit Totals:

You

can preview your current credit totals at any point in the billing cycle.

- Select a Fiscal Year and Month from the drop-downs on the WOTC Payroll & Credit Report page.

- Click Preview Current Credits. The system displays a report that is a snapshot of all WOTC credits through the month selected.

Note:

This is NOT a finalized billing or credit report, but you can view your total

current credits in process at any time during the billing cycle.

Updated: Jan 11, 2018

Related Articles

WOTC/ACA: Payroll Requirements Template & Guide

WOTC/ACA: Payroll Data Requirements Template & Guide Purpose: To ensure complete Client Payroll files for employee hours and wages are uploaded to the Efficient Hire Secure Drop Box by the Payroll deadline for the following: WOTC (Work ...WOTC: Overview & Training Presentation

ACA Reporting: Employee Data Guide

ACA Reporting: Employee Data Purpose: To ensure the data in EHX is accurate and complete for every employee hired within your Benefit Plan Reporting Year. Those employees are subject to receive a 1095C if certain criteria are met. New Employee Import ...ACA Reporting: Update & Finalize 1094C Company ALE Information

ACA Reporting: Update & Finalize 1094C Company ALE Information – 1094C Part III: ALE Monthly Information & ALE Member Information Purpose: The IRS deadline for receiving your Company 1094C/1095C Packet(s): March 31, 2019. In order for Efficient Hire ...ACA Reporting: IRS Form 1095C Codes & What They Mean

ACA Reporting: IRS Form 1095C Codes & What They Mean Purpose: The IRS has created two sets of codes in order to provide employers with a consistent way to describe their offers of health coverage. Each code indicates a different scenario regarding an ...